How Can We Help?

Asset Checkout Notifications

Overview

This notification type can be used for sending email alerts when an asset is due for return or is overdue.

Setting up the notification

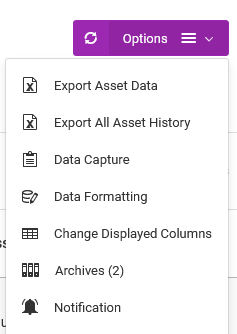

To set it up, go to the Manage Assets table > Options > Notifications or the Asset Checkout table > Options > Notifications.

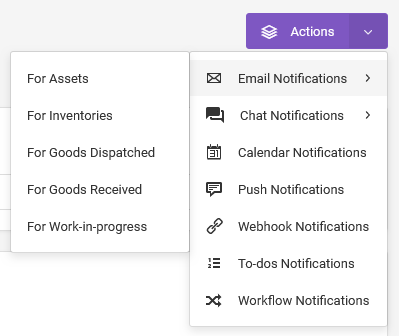

On the Notifications page, under the Actions menu, choose Email Notifications, then For Assets.

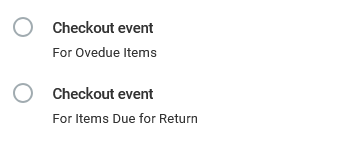

In the popup modal, choose one of the checkout events, then click on the Continue button.

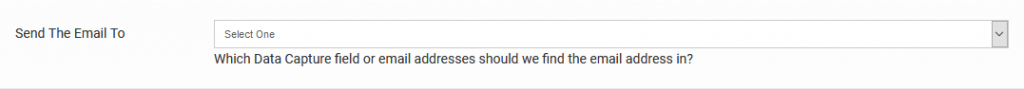

On the new page, choose who should receive the email notifications. Most likely these would be the custodians, so the data capture method is the ideal one.

- You can choose team members.

- You can enter the email addresses, under the “The following email addresses” section, if the recipients are the same for all the assets.

- If the recipients are different for specific assets, then you need to have their emails recorded on the asset’s record. To do so, you need a Data Capture field with the Answer Type set to either “Email”, “Select” or “Hidden”. For “Select” or “Hidden” Answer Types, specify the email address in the Options section of the Data Capture settings. “Hidden” Answer Type, can only have one email address, whereas “Select” can have multiple emails defined, but only one will be chosen when filling out the forms.

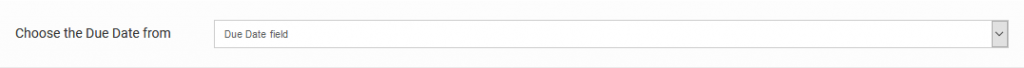

Choose where the app should look for the due date.

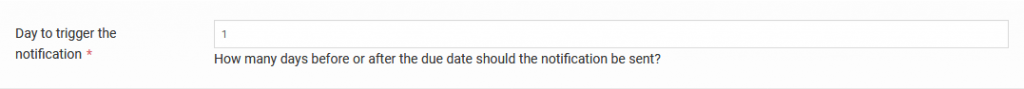

Indicate how many days before or after the due date, should the notification be sent. This is dependent on the notification type.

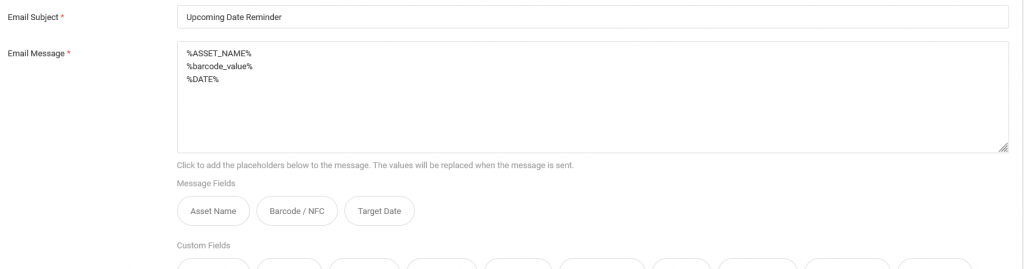

Compose the message. Use the placeholders if necessary.

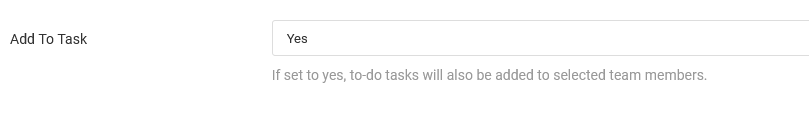

If the recipients of the emails are also users of the app, you can have the app create to-do tasks automatically whenever the emails are issued.

Modifying the notification

From the Notifications page, go to the Notifications table.

Find the notification you want to modify.

Under the Actions column, go to Edit.

To pause the notification, change its status to Inactive.