How Can We Help?

Asset Depreciation

Depreciation Methods

The platform supports depreciation calculations using the Straight-Line, Declining Balance (with a depreciation factor of 1.5), and the Double Declining Balance methods (with a depreciation factor of 2).

The current period’s depreciation expense will be shown in a custom field that you create.

Preliminaries

You need to create a couple of custom fields that will be used for the calculations.

Go to the Tagged Assets data capture page.

On there, create the following fields.

- A field, e.g “Depreciation Expense”, for showing the depreciation expense calculation results for the current period. This field should have the Answer Type, “Hidden“.

- A field, e.g “Service Date”, with the Answer Type, “Date“, that indicates when the assets were placed in service.

- A field, e.g “Asset Cost”, with the Answer Type, “Numeric“, that indicates the original value of your asset or the depreciable cost; the necessary amount expended to get the assets ready for their intended use.

- A field, e.g “Salvage Value”, with the Answer Type, “Numeric“, that indicates the value of the assets at the end of their useful life; also known as residual value or scrap value.

- A field, e.g “Useful Life”, with the Answer Type, “Numeric“, that indicates the expected time that the assets will be productive for their expected purpose.

Once all of those custom fields above have been set up, go to the Manage Assets > Tagged Assets table.

On the table, click on the Format button.

On the Data Formatting page, scroll to the Depreciation Fields section.

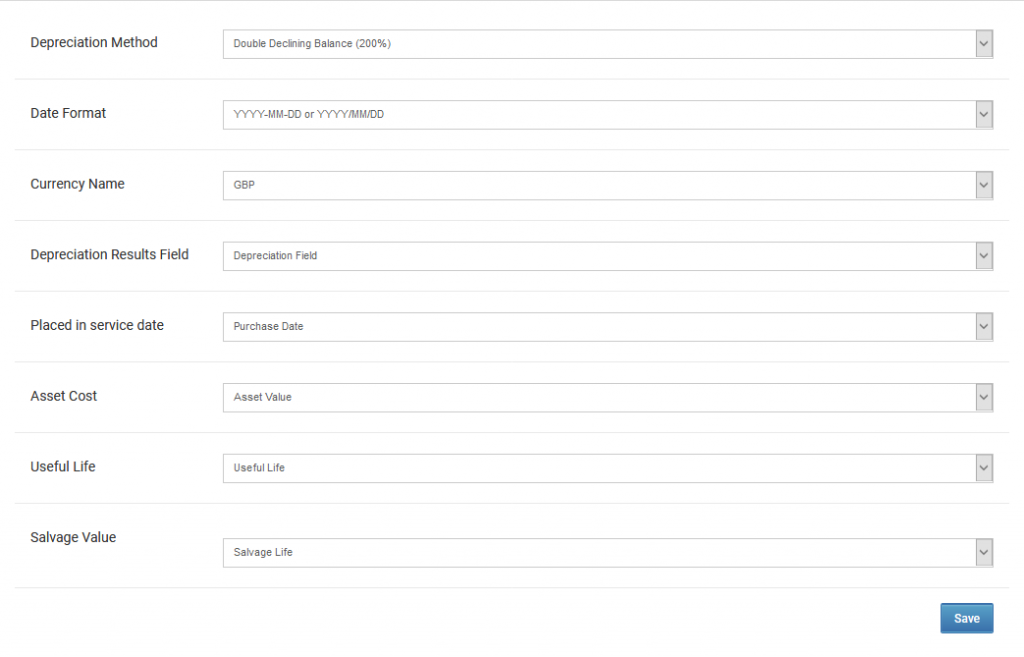

Under the Depreciation Method, choose either straight-line, declining balance, or double declining balance.

Under the Date Format, choose the date format that is used to record the date assets were placed in service.

Under the Currency Name, choose the currency the calculation results should be shown in.

Under the Depreciation Results field, choose the name of the hidden field that was set up as per the aforementioned instructions.

Under the Placed in Service Date, Asset Cost, Useful Life, and Salvage Value fields choose the corresponding custom fields that were created to capture the respective values.

Depreciation Expense

To view the depreciation expense calculation for the current period (year), have the custom field that captures this calculation displayed on the table.